A Beginner’s Guide To The UK Tax System.

As an immigrant to the United Kingdom, it’s important to get familiar with their tax system because the UK government relies heavily on taxes to fund public services, such as the National Health System, the education system and welfare projects.

This guide walks you through:

Types Of Taxes.

There are two types of taxes on any income earned in the UK:

Income Tax: As the name implies, income tax is money collected by the government from all your earnings. It is the primary revenue source for government activities and is usually collected by the HMRC (His Majesty’s Revenue & Customs). You are obligated to pay an income tax on money generated from the following sources:

Earnings from your job if you’re employed.

Interest on savings.

Benefits you get from your job.

Profits from your business if you are self-employed.

Rental Income.

2. National Insurance: While this is also a tax on your earnings, it serves a different purpose from the ‘Income Tax’. Contributing to National Insurance entitles you to state benefits, like the pension fund, maternity care etc.

Paying National Insurance is mandatory if you are over 16 and either:

Earn more than £242 weekly as an employee or,

Make more than £6,725 in yearly profit running a self-employed business.

Read our guide on how to apply for a National Insurance Number.

Tax Year & Tax Code Explained.

Tax Year: The tax year is a financial period lasting 12 months for individuals to sort their tax affairs in the UK according to the stated deadlines. For example, the current tax year runs from April 6, 2022, to April 5, 2023, and the deadline for filing online tax returns for this tax year is midnight, January 31, 2023. You can see a schedule of the deadlines for the current tax year here.

Failing to submit your tax return before the deadline usually attracts a penalty.

Note: You’d only have to submit a tax return by yourself if you are self-employed. In most situations, your taxes will be automatically deducted from your salary.

Tax Code: A tax code is an identification code made up of several numbers and a letter. It helps your employer/pension provider figure out how much of your earnings they are to deduct as tax and pass on to the HMRC.

Who Pays Taxes In The UK?

If you are a UK resident, you must pay taxes on all your local and foreign income. You count as a resident for tax purposes if:

You spent 183 or more days in the UK in the stated tax year.

Your only home was in the UK for 91 days or more in a row and you visited or stayed in it for at least 30 days of the tax year.

You worked full-time in the UK for any period of 365 days and at least one day of that period was in the tax year you’re checking.

How To Pay Your Tax.

The most common way to pay income tax in the UK is through PAYE (Pay As You Earn). With the PAYE system, your employer deducts your Income Tax and National Insurance contribution before paying your earnings. Your employer knows how much to remove through your ‘tax code’ shared with them by the HMRC.

If you’re self-employed, you’ll have to pay your income tax and national insurance contribution through self-assessment. To do so, register a personal tax account with the HMRC.

You should also have a personal tax account if you want to see your tax code and records as an employee. To create one, you’ll need the following:

Your National Insurance Number.

Your Passport.

Or a recent P60 from your employer.

What Determines The Amount You Pay As Tax?

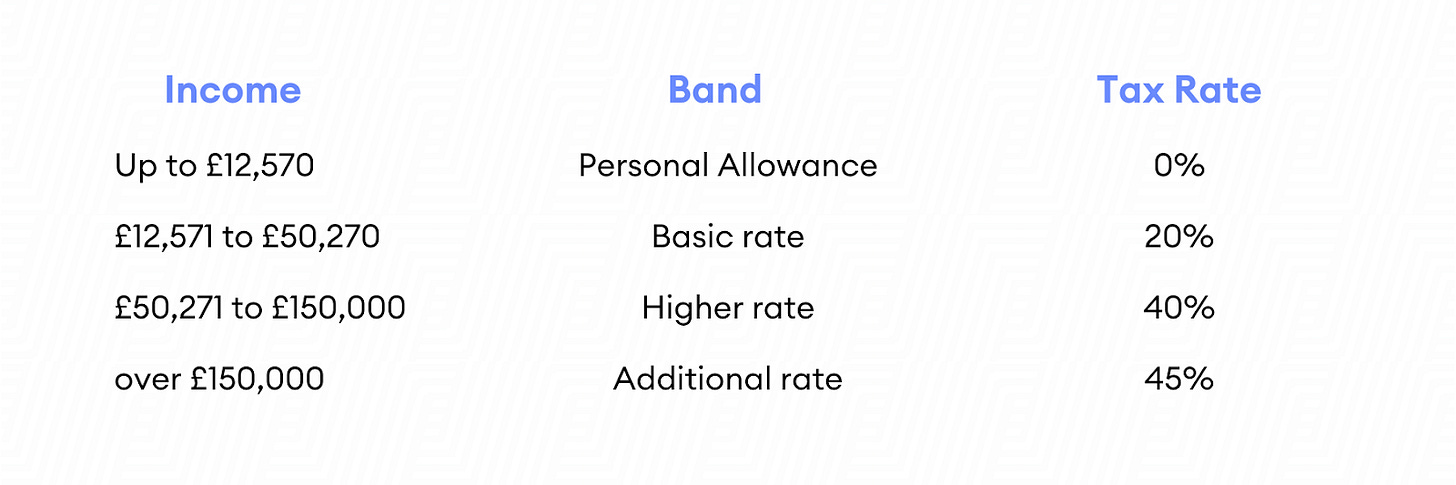

Every UK resident has a personal allowance, which is how much you can earn as income before you’re obligated to start paying an income tax.

For example, the personal allowance for the 2022/2023 tax year is £12,570. This means that you are exempt from paying taxes if you earn below that amount. Paying taxes is mandatory as long as you earn above the amount set as a personal allowance.

The UK operates a progressive tax system which means your tax rate increases as your income increases. Here is how much you can expect as a tax rate based on your income level:

Did you find this article helpful? Tap the button below to share.