How To Open A Personal Bank Account In Dubai.

The United Arab Emirates is one of the most attractive expat destinations with a steady influx of people immigrating for work, and business related reasons. If you have definite plans to move to Dubai, one of most essential requirements for your day-to-day activities is a bank account.

In this guide, we break down what you need to open a bank account in Dubai, the most popular banks, and other helpful information.

Can I Open A Bank Account From Outside Dubai?

While most banks in Dubai offer the option to create an account online, they typically require credentials that are challenging to obtain if you are not in the country, such as an Emirates ID or UAE phone number. Moreover, as a new resident or arrival, most banks will ask that your provide your signature in the presence of a bank officer.

An alternative approach here is to employ a financial representative in Dubai to act on your behalf which may allow you to open a bank account remotely. However, not all banks accept this.

What Documents Do I Need To Open A Bank Account In Dubai?

The standard documents required to open a bank account in Dubai are usually the following:

Your passport.

A recent utility bill or rental contract to serve as proof of address.

An Emirates ID card - mandatory for all citizens and residents of the UAE.

A copy of your visa.

A copy of the last six months of your personal bank statements from where you were previously resident.

A document showing your employer’s name and your salary amount.

As a new resident, most banks would let you open a bank account on the strength of your Emirates ID application, but you’ll still need to show your ID upon its arrival to avoid losing service. Some of the reasons why a request to open a bank account may be rejected are:

If you cannot provide documents confirming your employment status and the nature of your job.

If you cannot confirm the source of your funds.

If another bank has blocked your account due to suspicious activity.

Therefore, ensure all necessary documents are in order before initiating the application process.

Types of Bank Accounts In Dubai.

Current Accounts: This option works best for everyday transactions, and also comes with a check-book allowing you to issue rent checks to your landlord. Also, if you’re employed, opening a current account with the bank your employer uses allows you to receive salary transfers much faster.

Investment Accounts: This type of account is for those looking to sign an investment agreement with a bank, which could run anywhere from 12 months to a longer period of time, 5 years, 10 years or more. There are guaranteed returns on funds per year, usually ranging from 3 to 7% per annum.

Savings Accounts: This option offers higher interest rates than current accounts but without the benefit of a check-book, and you may have limited access to funds with penalties attached to withdrawals.

Offshore Accounts: Given its reputation as a tax haven, offshore banks around the world offer representation in the UAE allowing anyone with a valid residence visa to open an offshore account. Some of the major offshore banks here are Barclays, HSBC Offshore, Abbey National Offshore.

Popular Banks In Dubai.

Here are some of the most widely used banks in Dubai to consider when looking to open an account:

Emirates National Bank of Dubai: As one of the biggest banking groups in the Middle East, Emirates National Bank has a huge network of bank branches and ATMs in Dubai, with attractive offerings like a free debit/credit card, and pre-approved overdraft services.

HSBC: Being one of the world’s largest financial institutions, it’s no surprise that HSBC is present in Dubai with a full range of service offerings including savings and current accounts, wealth management, credit/debit cards, loans and mortgages among others.

Dubai Islamic Bank: Known for its personalized service and offerings including savings and current accounts, loans, and more.

First Abu Dhabi Bank: First Abu Dhabi Bank is the largest bank in the UAE and offers a very comprehensive suite of financial services, and a large network of branches.

Some of the things to consider before choosing a bank to go with are:

Whether your employer banks with them so you can easily receive your salary payments.

Withdrawal limits per month.

Associated fees and penalties, which may vary from bank to bank.

Fees To Expect.

Most banks in Dubai enforce a minimum balance requirement, typically AED 3,000, with penalties for falling below this threshold. Additional fees may include monthly maintenance charges, transfer, and withdrawal fees. It's very crucial to carefully review the specific fees associated with your account type and chosen bank.

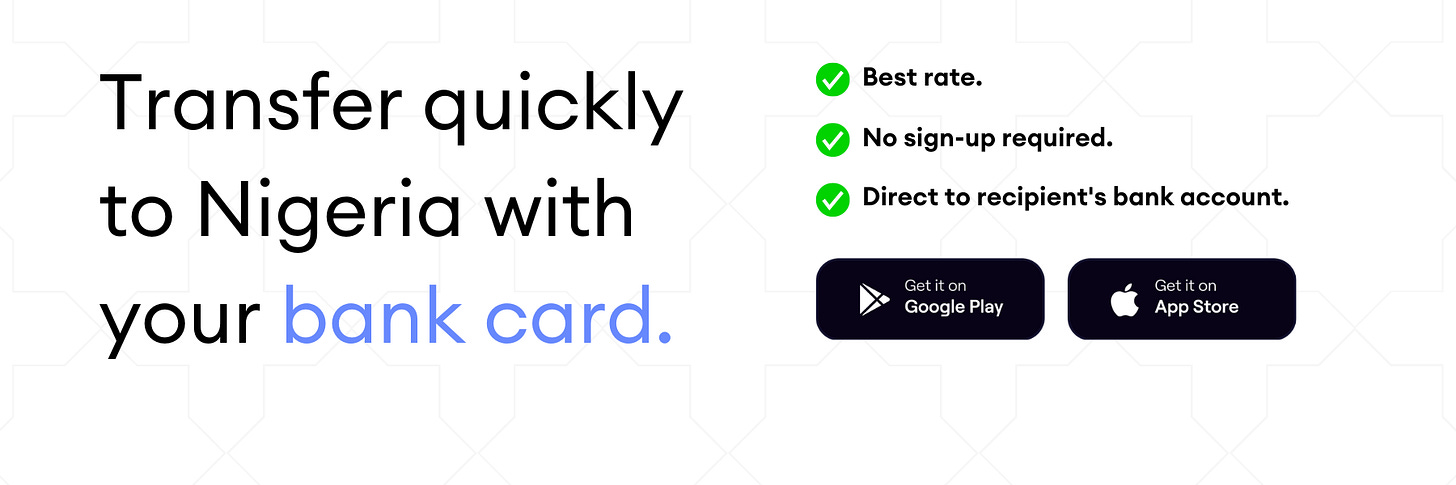

Sendcash makes it easy to send money to Nigeria from Dubai at the best rate. No hidden fees, no payment delays. Tap the button below to use it for your next transfer to family and friends in Nigeria.