Crypto Corner: Stablecoins Explained.

A beginner's guide to stablecoins.

As a crypto-powered remittance platform, we regularly get asked questions about crypto from people new to the space, which is only natural.

So to better answer the questions we are frequently asked, we decided to launch Crypto Corner: a content series for people new to crypto where we concisely walk you through crypto concepts/topics in an easy-to-understand manner.

Our first article in this series explores stablecoins, their meaning, and why it exists.

What Are Stablecoins?

If you have paid attention to any news concerning cryptocurrencies lately, you'd be aware of the sharp dip in the market value of many crypto assets. Simply put, general crypto adoption is still in the early stages. As such, the crypto market can be very susceptible to external factors, which is why cryptocurrencies are commonly recognized as being volatile.

The hallmark volatility of cryptocurrencies is why stablecoins exist.

Stablecoins are cryptocurrencies (digital currencies) that have their value tied or pegged to a stable asset, usually a fiat currency like the euro or dollar.

Types Of Stablecoins.

Fiat-backed stablecoins: These are the most popular type of stablecoins. They have their value pegged 1:1 to that of fiat currencies like the US dollar. For every fiat-backed stablecoin, there has to be a proportionate amount of fiat currency held in reserve to guarantee its value.

An example is USDT (Tether), the world's largest stablecoin whose value is pegged to the US dollar. Every USDT created has a dollar held in reserve to back it, so 1 USDT always equals 1 dollar.Other fiat-backed stablecoins are USD coin (USDC) and Binance USD (BUSD).

Crypto-backed stablecoins: As the name implies, crypto-backed stablecoins have their value pegged to that of a cryptocurrency. We know this might seem a bit confusing because if cryptocurrencies are typically volatile, how can the value of a stablecoin pegged to one be guaranteed?

To address the volatility of cryptocurrencies, crypto-backed stablecoins tend to over-collateralize their reserve, i.e. they don't use a 1:1 peg the way fiat-backed stablecoins do.

Some examples of crypto-backed stablecoins are DAI and Wrapped Bitcoin.Commodity-backed stablecoins: These are stablecoins that have their value pegged to that of real-world commodities like gold, silver, oil, and real estate.

Commodity-backed stablecoins work great for people who want to invest in a commodity without going through the hassle of sourcing for it.Algorithmic stablecoins: Unlike the other types of stablecoins that we've highlighted, algorithmic stablecoins aren't backed by fiat, physical or crypto assets.

Instead, they are regulated by specialized algorithms designed to maintain their value. These algorithms control the supply and availability of the stablecoin based on the demand for it.

Why Is There A Need For Stablecoins?

It's easy. Stablecoins confer a cryptocurrency's advantage without any wild price swings or value fluctuation. For example, if you stay in the US and want to send $500 to someone in Nigeria via wire transfer, the process of doing that transfer can be tedious, and it might take days before it's delivered, not to talk of the fees you'll get charged on top.

With a stablecoin like USDT, whose value is tied to the dollar, you can do that transfer way faster and at almost no fee by just sending USDT directly to the crypto wallet of your recipient. No third-party interference, no steep fees.

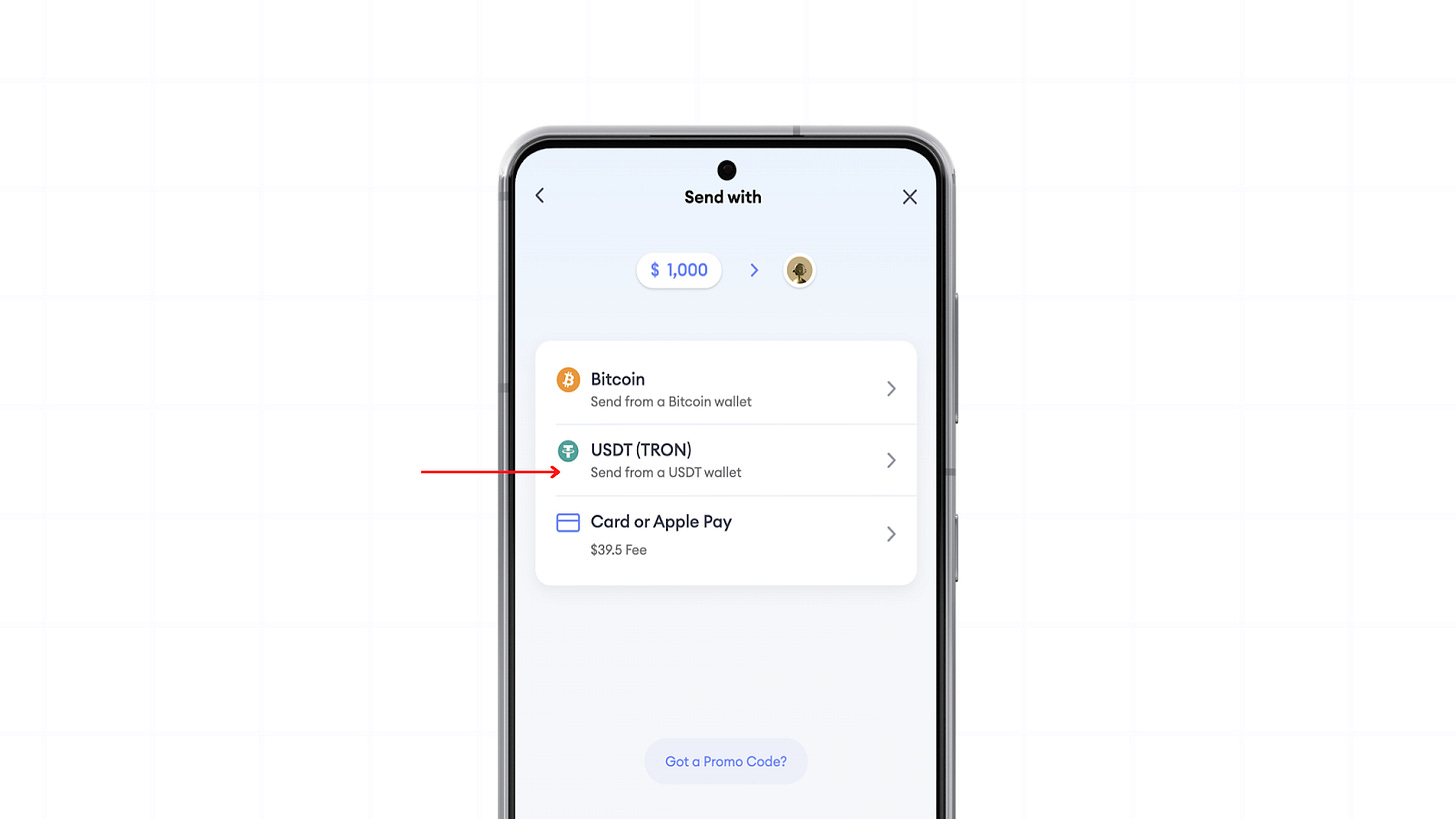

In conclusion, stablecoins are a great way to do cross-border transactions because the limits of traditional finance don't apply, which is why we recently introduced USDT as a payment method on Sendcash.

Also, stablecoins serve as a great store of value, especially in countries with weak currencies.

If you enjoyed reading this, consider sharing it with your friends by tapping the button below.